The fact is that around are and constantly often getting home loan choices for individuals which do not provides a large down percentage. Listed below are four loan alternatives for whoever has 5 % otherwise shorter for a deposit.

#1: Conventional financing having PMI

Mortgage insurance policy is an agenda one to repays the lender is new debtor standard. The new debtor covers which insurance coverage with regards to month-to-month mortgage payment. This extra cost might be worthwhile even if.

State property is sold for $200,000. A great 20% down payment try $forty,000. That’s a lot for brand new homebuyers. https://paydayloanalabama.com/snead/ A beneficial 5 percent off is far more feasibly, just $ten,000. An effective PMI policy are located at a price of about $150 so you’re able to $300 per month, dependent on credit history. However, this helps bring down the new barriers to homeownership rather.

#2: Federal Homes Management (FHA) funds

Recently, FHA could have been the product quality getting basic-date homebuyers. Even if which is moving on on account of improved products when you look at the conventional financing, he is however quite popular.

FHA loans require as low as step three.5% down, a little less versus traditional requirements. Meaning to the an effective $two hundred,000 mortgage, the minimum downpayment is $seven,000.

An enthusiastic FHA loan features a month-to-month home loan insurance coverage demands including a good antique loan, but inaddition it keeps a keen initial mortgage advanced, or MIP. The new MIP was 1.75% of your loan amount, or perhaps in this case a supplementary $3,five hundred. not, so it initial premium need not be paid off pocket and certainly will be folded on amount borrowed.

The fresh month-to-month home loan top for an enthusiastic FHA financing is generally 1.35% of your amount borrowed per year, divided into a dozen equal payments and you may put in this new payment per month. For example, an excellent $200,000 overall amount borrowed would want $225 monthly for the home loan insurance policies.

Though a keen FHA loan is far more pricey than simply the old-fashioned equivalent, permits to have a lower credit history while offering so much more easy earnings criteria, therefore it is an informed system for the majority of home buyers.

#3: Virtual assistant money

This program is an alternate entitlement offered to effective obligations group and you may veterans of one’s You.S. armed forces. The Va financing requires zero deposit at all. On top of that, there is no monthly mortgage top, just an initial premium, always dos.3% of the loan amount.

Brand new limited costs associated with so it loan create the fresh new clear choice for current and you will former members of the fresh military.

Whoever has offered within the twigs of the armed forces such as the Federal Protect otherwise Reserves was qualified.

#4: USDA loans

Sometimes referred to as the fresh Outlying Invention Financing, the fresh new USDA program requires zero down payment. As the identity implies, the program was created to help borrowers buy and you can finance good property within the outlying, quicker towns.

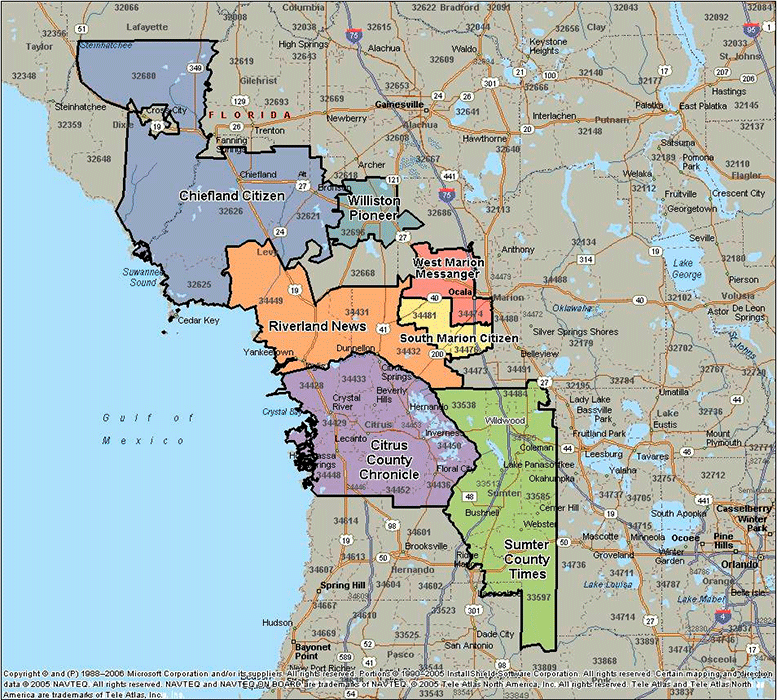

In order to be eligible for an effective USDA loan, the house need certainly to earliest be located into the an eligible town. This type of components are mapped on the USDA website. This is the beginning consumers will be trip to find out if a prospective house is qualified. Because of the entering the target on the website, the latest property’s eligibility could be determined.

Qualified areas are rural in the wild, but believe it or not, of many qualified parts are suburbs regarding bigger urban centers. Even though you do not think the room where you’re looking to get a home is approved, its worth looking at the USDA loan map.

#5: Federal national mortgage association HomePath loans

Federal national mortgage association provides a listing of foreclosed attributes that it now offers offered on the site HomePath. Customers look for house within their city with an easy urban area otherwise Area code search.

Homebuyers can purchase such residential property with just 5% down. Additionally, buyers receiving a gift out of an eligible current supply only need $five-hundred of one’s own currency.

Rather than a standard traditional mortgage, Federal national mortgage association HomePath funds do not require mortgage insurance policies or an assessment. A number of the services is wanting repair, nonetheless bring a good options, specifically for earliest-time homebuyers who possess nothing to place down on an effective household.

Lenders possess noticed that it’s impractical to require an excellent 20% advance payment provided the current home values. That’s why of many software arrive, also to people with quicker-than-prime credit and you can little money stored.

And you may latest interest levels ensure it is a great deal more reasonable buying a home. Contact a professional financial to find out and therefore of them software my work good for you.