This new Fannie mae HomeReady home loan program brings an unbelievable possible opportunity to pick a property, otherwise re-finance an existing home loan. This method also offers flexible requisite assistance, competitive financing words, and a reduced advance payment solution.

Federal national mortgage association HomeReady System Highlights

- 3% deposit You could potentially financing as much as 97% in your home pick (97% LTV). It is possible to debtor the bucks utilized for the deposit, it does not need are from your money.

- Affordable and you may cancellable financial insurance The borrowed funds insurance policies toward HomeReady try cheaper than other kinds of mortgage loans, in addition to other customary funds. you will get terminate the financial insurance coverage once you’ve during the minimum 20% equity (a keen 80% LTV or all the way down).

- All the way down interest rates The interest rates towards HomeReady was below other sorts of mortgage loans, in addition to old-fashioned and authorities-insurance policies mortgage loans, such as for instance FHA financing.

- Versatile earnings conditions There clearly was significant amounts of flexibility in what money can also be be employed to qualify for your own mortgage. As previously mentioned significantly more than, you can use the income out-of the people on your own household, whether or not they are on the mortgage or perhaps not. It’s also possible to explore boarder money, which is money amassed regarding renting out a bedroom otherwise section of your home, including a cellar, otherwise mother-in-law device, that are also known as connection hold equipment (ADU). And, you can get a non-occupant co-borrower, which in almost every other conditions, means it’s possible to have a great cosigner that will not real time during the the brand new residence you buy.

Desire to find out if you be eligible for the newest HomeReady home loan program? We could help fits your that have a home loan company that offers HomeReady financing on the place.

Federal national mortgage association HomeReady System Standards

- Credit score The minimum credit rating needs was 620. Some loan providers need a higher rating, but one appears to be a low FICO rating which is are acknowledged.

- Maybe not a recent citizen You should not already very own various other property. You don’t have are a first and initial time domestic client, you could not currently be a resident.

- Resident group You need to complete a homeowner studies loan places Fruitdale path. This is certainly known as the Construction homebuyer knowledge path. Just one debtor has to participate, and it will performed online, as well as their pace.

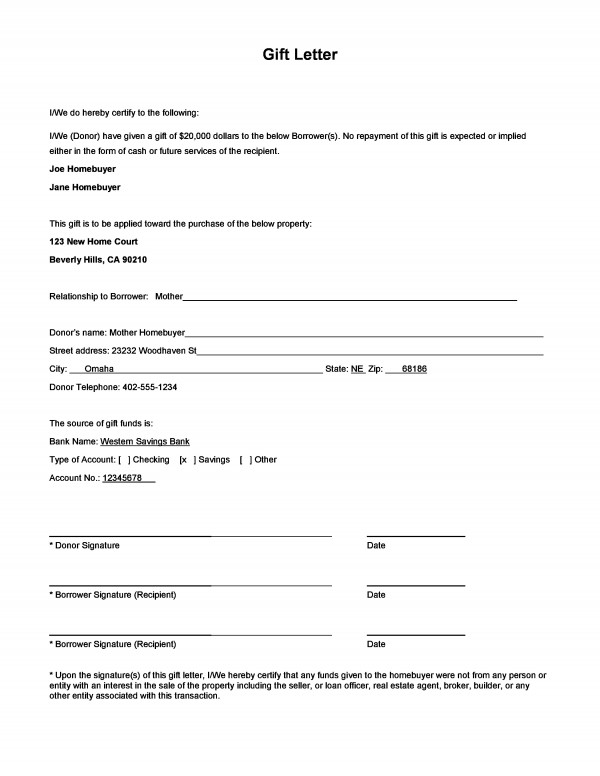

- Deposit The minimum advance payment requirement is step three%. That it money can be lent, skilled, otherwise come from a down payment direction program. You don’t have to make use of the funds (cash on hands otherwise regarding a checking account that you individual), as well as often needed together with other variety of mortgages.

- Income Requirements As stated above, there’s a lot out-of independence with what income are familiar with meet the requirements. The maximum DTI proportion (debt-to-money ratio) is 50%. Thankfully, you can use the money out of most of the participants on the house in order to meet the requirements, whether they are associated or not. Together with, they do not have to take the mortgage, so some one surviving in the house are able to use its money so you’re able to make it easier to qualify.

- Income Limitations There are even earnings restrictions restricting how much cash you makes. There are not any earnings constraints a number of nations, such components which have lower income, high minority parts, and you may appointed emergency portion. In more wealthy places, the amount of money limits is actually a hundred% of your average average earnings of this area. Searching within the money restrictions because of the appearing a speech to your Federal national mortgage association site.

Talking about a few of the basic criteria toward HomeReady financial system. If you’d like to find out if your qualify for HomeReady, we could assist suits your which have a loan provider on the area. For a lender get in touch with you, fill in this form . It is possible to see some HomeReady lenders below.